Press release

Ituran Increases Dividend To 6% After Posting Record-Setting 2023 Operational Performance ($ITRN)

Ituran Location and Control (NASDAQ: ITRN [https://www.ituran.com/ituranglobal/]) presents a compelling investment proposition. In fact, with a forward-looking dividend yield of 6%, this innovative technology company, which averages roughly 57,000 shares traded daily, may present a value disconnect too wide to ignore. That's not an overly aggressive assessment, either. Considering this company posted record across-the-board financial metrics, including a 9% revenue increase in year-over-year to $320 million, net income of $48 million, an increase of 30% year-over-year, and a 10% increase in EBITDA to $87 million, ITRN's market cap of $530 million, while impressive by most listing standards, may actually fall short of an appropriate fair value.An analyst at Barclay's covering ITRN stock makes that case, modeling a 12-month price target for ITRN shares to reach $35, over 30% higher than its current price. That expectation is bullish but not overly so. In addition to its record revenues, the company also generated $77 million in FY2023 operating cash flow as it continues to earn deals from global companies interested in its revolutionary telematics and connected car ecosystem. The interest is warranted. While some of ITRN's competitors do one of two things well, Ituran does many by leveraging strength from a full spectrum of innovative software solutions, in-vehicle sensors, and unique services and system functionality that do more than address challenges; they overcome them.

That distinction can do more than drive revenues higher from already record levels; it also supports the evidence-based case that the path of least resistance for ITRN shares is currently paved higher.

Image: https://www.abnewswire.com/uploads/ada54c2b56010a594e9d35dd9cabfe2e.jpg

Ituran is Ushering in the Shift in Mobility Technology

The bullish expectation is justified, especially as Ituran continues strengthening its leadership position in the emerging mobility technology field by providing value-added location-based services, particularly its full suite of services for the modern connected car. While under the radar of investors, that's not the case from a client-and-use perspective.

Served by its 2,800 employees from offices worldwide, Ituran is the largest OEM telematics provider in Latin America, with its products and applications used by customers in over 20 countries. And a lot of them. By the end of 2023, subscribers wanting Ituran products and services reached almost 2.3 million subscribers increasing by 186,000 during the year and meeting growth guidance despite the challenging economic and geopolitical market landscapes.

In addition to scoring record operating performances, Ituran ended the year financially solid, with year-end net cash and marketable securities of $53 million. Here's the better news from those investors liking to get "paid to wait" for growth. In Q4, Ituran added to its dividend distribution accounts and bought back over $6.6 million in shares, representing a 6% passive income yield and a value driver from a forward-looking valuation perspective, respectively. The latter is significant, considering that the company only has about 20 million shares outstanding on a fully diluted basis.

Operating Momentum After an Impressive Q4/2023

Attracting investors and supporting the bullish analyst model is that year-end results were strengthened by an impressive Q4. For the period, net subscriber growth, meaning recurring revenue stream providers, increased by 42,000 when combining the new aftermarket subscribers of 38,000 with the net increase in OEM subscribers of 4,000. Revenues increased by 4% to $78 million, leading to net income of $12 million, 26% higher than a year ago. The performance prompted the Board to increase the dividend policy by 60% to $8 million for the quarter, a run rate of $32 million per year, based on the growing profitability and strong operating cash flow.

It also led to optimistic guidance about expectations in 2024. Management said it expects to add approximately 35,000 to 40,000 net new subscribers each quarter during 2024, contributing to EBITDA projections between $90-95 million. In 2025, EBITDA is targeted to surpass $100 million. Management did note that these targets are based on current exchange rates and assume that Israel's current global macroeconomic situation and political situation do not significantly change. Still, if Mid-East tensions ease, the potential to beat is undoubtedly in play, noting the company's business resilience during challenging times.

Keep in mind that hardware installations and, therefore, product revenues were paused for at least several weeks following the outbreak of war in Israel on October 7. That caused some declines in a quarterly comparison. However, year-over-year, Ituran accomplished what it and investors want and appreciate- growth. Better still, despite supply-chain issues, gross margins stayed impressive, with subscription revenues at around 58%, and the gross margin on products at 22%. That facilitated Q4 operating income to increase by 8% to $16.5 million compared to $15.3 million in the fourth quarter of last year.

Value Drivers are Active in 2024

From an investor perspective, financial results, interim project updates, and 2024 guidance have guided expectations for the Ituran growth spurt to continue. And the best news from that same standpoint is that the company shares the wealth earned. In addition to the increased dividend, the company will continue its previously announced $25 million share buy-back program, which increased to $35 million, last February. With roughly $6.7 million remaining under that authorization, it's more than support at the bid; it's a value driver that can steepen the growth curve trajectory when new milestones are reached.

And there could be many contributing factors. During its recent earnings conference call, ITRN noted that value drivers accrue from different segments, including those created by insurance companies and car owners, especially in Israel, who are looking for effective security systems to protect assets. Because Ituran solutions are considered best-in-class in many respects, it can leverage that distinction and add to already appreciating levels of subscriber growth.

In other countries, Ituran is focused on monetizing market opportunities on the B2B side, working with financial institutions to offer asset protection and security solutions when they provide loans to new car buyers. In Latin America, where there has been an increase in car theft and damage from violence, the company is focused on penetrating those markets more quickly this year to exploit that revenue-generating market opportunity and add traction to its goal of surpassing $100 million in 2025 EBIDTA. That goal is within reach.

Remember, the subscriber base is growing at 9%. And with upsells for its products more the norm than the exception, tracking higher to meet that projection is more than just an ambitious target; it's in the company's crosshairs. Coupled with financial efficiencies, a management team committed to ensuring revenues fall faster to its bottom line, and increasing global demand for the kinds of security solutions Ituran provides, this dividend-bearing stock looks very attractive at current levels, even more so with a 6% yield, which could also move higher if guidance is met. In other words, investors could earn while they earn , which may be the ultimate win-win investment proposition.

Disclaimers: This content has been created by Hawk Point Media Group, Llc. (HPM) and is responsible for the production and distribution of this content. This presentation should be considered and explicitly regarded as sponsored content. Hawk Point Media Group, LLC. has been compensated twenty-thousand-dollars to create this content as part of a more extensive digital marketing program by an unrelated third party of the company. Accordingly, this content may be used and syndicated beyond the channels used by Hawk Point Media, Llc. This disclaimer and the link to the broader disclosures must be part of all reproductions. That compensation creates a conflict of interest because the content presented may only provide a favorable viewpoint of the company featured. The contributors do NOT buy and sell securities before and after any article, report, or publication. HPM holds ZERO shares and has never owned stock in Ituran Location and Control Ltd. The information in this video, article, and related newsletters is not intended to be, nor does it constitute, investment advice or recommendations. Hawk Point Media Group, Llc. strongly urges you to conduct a complete and independent investigation of the respective companies and consider all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. Never take opinions, articles presented, or content provided as the sole reason to invest in any featured company. Investors must always perform their own due diligence before investing in any publicly traded company and understand the risks involved, including losing their entire investment. For the complete disclosure statement, including compensation received, click HERE [https://hawkpointmedia.com/disclaimer-and-disclosures-itrn-0424-2/].

Media Contact

Company Name: Hawk Point Media

Contact Person: Editorial Dept.

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=ituran-increases-dividend-to-6-after-posting-recordsetting-2023-operational-performance-itrn]

Country: United States

Website: https://ituran.com/ituranglobal/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Ituran Increases Dividend To 6% After Posting Record-Setting 2023 Operational Performance ($ITRN) here

News-ID: 3463889 • Views: …

More Releases from ABNewswire

Ghaaneh Saffron Sets New Benchmark for Authenticity and Quality in Dubai's Saffr …

Dubai, UAE - 16 May, 2024 - Ghaaneh Saffron, a leading name in the saffron industry, is proud to announce its emergence as the premier saffron wholesaler in Dubai. With a commitment to quality, authenticity, and customer satisfaction, Ghaaneh Saffron is revolutionizing the saffron market in the region.

As the demand for high-quality saffron continues to rise, Ghaaneh Saffron stands out as a trusted supplier offering premium-grade Iranian saffron. With a…

Redway Power Introduces Innovative Solutions for Electric Golf Carts

Redway Power introduces cutting-edge solutions for electric golf carts, revolutionizing sustainable transportation on golf courses. With zero emissions, quiet operation, and lower maintenance costs, these innovative carts elevate the golfing experience while minimizing environmental impact. Learn more about Redway Power's commitment to sustainability.

Redway Power, a leading provider of energy solutions, is proud to announce its latest initiative aimed at revolutionizing sustainable transportation on golf courses. With the introduction of innovative…

Estate Vision introduces a safe route to high-quality, intent-driven leads for r …

By utilizing Estate Vision, you can seamlessly enhance your monthly earnings with an additional 1-2 successfully closed deals, effortlessly and without any associated risks. This newfound efficiency also provides you with the freedom to allocate your precious time to endeavours beyond the scope of the real estate domain. Opt for Estate Vision to elevate your real estate career.

Real estate professionals seeking to supercharge their business prospects have a promising ally…

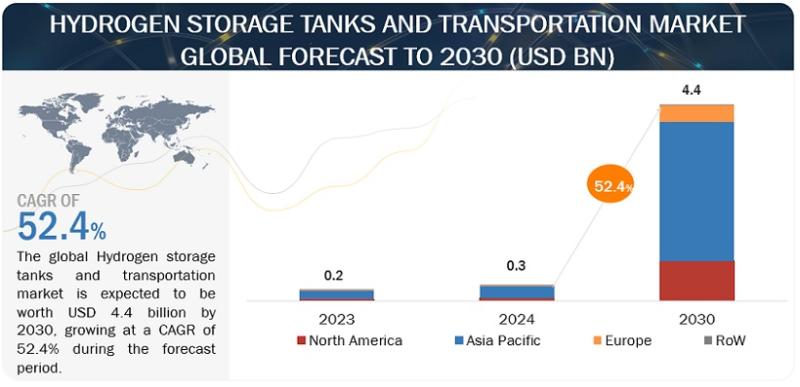

Hydrogen Storage Tanks and Transportation Market Size to Reach $4.4 billion by 2 …

The global Hydrogen Storage tanks and transportation market is projected to reach USD 4.4 billion by 2030 from an estimated USD 0.3 billion in 2024, at a CAGR of 52.4% during the forecast period.

According to a research report "Hydrogen Storage Tanks and Transportation Market [https://www.marketsandmarkets.com/Market-Reports/hydrogen-storage-tanks-transportation-market-191929668.html] by Modular Storage (Fuel Storage, Distribution Systems), Application (Vehicles, Railways, Marine, Stationary Storage, Trailers), Tank Type (Type 1, 2, 3, 4), Pressure and Region -…

More Releases for Ituran

Stolen Vehicle Recovery Market Trending Forecasts with Growth Scenario by 2028 � …

Stolen Vehicle Recovery Market study by “The Insight Partners” provides details about the market dynamics affecting the market, Market scope, Market segmentation and overlays shadow upon the leading market players highlighting the favorable competitive landscape and trends prevailing over the years.

The stolen vehicle recovery solution is a reliable and effective system to reduce the chances of vehicle theft with the help of numerous components, such as remote keyless entry system,…

Stolen Vehicle Recovery Market 2027 | Comprehensive Study COVID19 Impact Analysi …

The stolen vehicle recovery solution is a reliable and effective system to reduce the chances of vehicle theft with the help of numerous components, such as remote keyless entry system, central locking system, ultrasonic intruder protection system (UIP), and automatic collision detection system. This solution comprises detection, prevention and response to threats with the help of technologies, such as radio frequency identification, and ultrasonic. The stolen vehicle recovery solution providers…

Fleet Management Solutions Market 2019 Growing in Revenue Making CAGR of 12.88% …

The fleet management solutions market is expected to witness a CAGR of 12.88% over the forecast period (2018 - 2023). The report includes insights on the solutions offered by major players including providers of hardware, professional services, and integration solutions. The regions included in this study are North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. The study offers insights on various end-user verticals as construction, energy &…

Fleet Management Solutions Market 2019 Industry Size, Key Vendors (Arvento Mobil …

Fleet Management Solutions Market studies include a range of functions, such as vehicle financing, vehicle maintenance, vehicle telematics, driver management, speed management, fuel management and health and safety management.

Get Sample Copy of this Report @ https://www.orianresearch.com/request-sample/682863

This report studies the Fleet Management Solutions market status and outlook of Global and major regions, from angles of players, countries, product types and end industries; this report analyzes the top players in global market,…

Fleet Management Solutions Market Share Analysis 2018-2023 by Major Players: Arv …

MarketResearchNest.com adds “Global Fleet Management Solutions Market 2018 by Manufacturers, Regions, Type and Application, Forecast to 2023”new report to its research database. The report spread across in a 137 pages with table and figures in it.

Fleet (vehicle) management can include a range of functions, such as vehicle financing, vehicle maintenance, vehicle telematics, driver management, speed management, fuel management and health and safety management.

Scope of the Report:

This report studies the…

Fleet Management Solutions Market is expected to register a CAGR close to 12.88% …

Marketprognosis.com Publish a New Market Research Report On “Global Fleet Management Solutions Market 2018 - 2023” which contains global key player’s survey information and forecast to 2023.

Overview of the Global Fleet Management Solutions Market:

The Global Fleet Management Solutions Market is expected to witness a CAGR of 12.88% over the forecast period (2018 - 2023).

The report includes insights on the solutions offered by major players including providers of hardware, professional services,…