Press release

Decentralized Insurance Market to Reach $135.6 Billion, Globally, by 2032 at 58.5% CAGR : Unleashing Growth

Allied Market Research published a report, titled, "Decentralized Insurance Market by Type (Life Insurance, Non-life Insurance), by End User (Businesses, Individual): Global Opportunity Analysis and Industry Forecast, 2022-2032". According to the report, the global decentralized insurance industry generated $1.4 billion in 2022, and is anticipated to generate $135.6 billion by 2032, witnessing a CAGR of 58.5% from 2023 to 2032.➡️𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 :

https://www.alliedmarketresearch.com/request-sample/75321

Prime determinants of growth

The increase in demand for decentralized and peer-to-peer insurance products that offer greater transparency, lower costs, and faster claim processing times boosts the growth of the decentralized insurance market. In addition, the decentralized insurance sector is growing as a result of increased knowledge, adoption, and use of blockchain technology and smart contracts, which can automate insurance plans and claims. However, lack of regulation and limited insurance coverage restrains the market growth. On the contrary, the ability to offer more personalized insurance products that meet the specific needs and preferences of individual policyholders is expected to offer remunerative opportunities for the expansion of the decentralized insurance market during the forecast period.

Covid-19 Scenario

Due to the COVID-19 pandemic, decentralized insurance got increased attention as an alternative to traditional insurance models.

However, the pandemic created greater awareness of the importance of insurance and increased demand for insurance products, including those offered through decentralized platforms. This, in turn, presented various growth opportunities for companies operating in the decentralized insurance market.

The non-life insurance segment to maintain its leadership status throughout the forecast period

Based on type, the non-life insurance segment held the highest market share in 2022, accounting for more than three-fifths of the global decentralized insurance market revenue, and is estimated to maintain its leadership status throughout the forecast period, as it provides numerous benefits including increased transparency, lower costs, greater accessibility, improved security, faster claims processing, and customizable coverage options, which aids the firm in future marketing decisions. However, the life insurance segment is projected to manifest the highest CAGR of 61.7% from 2023 to 2032, as it provides policyholders with faster payouts and a more seamless claims experience.

➡️𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐖𝐞 𝐨𝐟𝐟𝐞𝐫 𝐜𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐞𝐝 𝐫𝐞𝐩𝐨𝐫𝐭 𝐚𝐬 𝐩𝐞𝐫 𝐲𝐨𝐮𝐫 𝐫𝐞𝐪𝐮𝐢𝐫𝐞𝐦𝐞𝐧𝐭 : https://www.alliedmarketresearch.com/request-for-customization/A74837

The individuals segment to maintain its leadership status throughout the forecast period

Based on end user, the individual segment held the highest market share in 2022, accounting for more than two-thirds of the global decentralized insurance market revenue, and is projected to manifest the highest CAGR of 60.5% from 2022 to 2032, owing to the use of methods such as time of arrival (TOA), angle of arrival (AOA), and time difference of arrival (TDOA). Decentralized insurance has become more accessible to individuals as new platforms and services emerge. This has created more opportunities for individuals to secure low-priced insurance plans outside of traditional insurance providers.

North America to maintain its dominance by 2032

Based on region, North America held the highest market share in terms of revenue in 2022, accounting for nearly two-fifths of the global decentralized insurance market revenue, owing to the increase in popularity of blockchain technology and the need for more accessible and affordable insurance options. However, the Asia-Pacific region is expected to witness the fastest CAGR of 63.4% from 2023 to 2032, and is likely to dominate the market during the forecast period, owing to the increase in adoption of blockchain technology, increase in demand for transparency and accessibility in insurance products, and the growth in popularity of DeFi platforms.

Leading Market Players: -

Nexus Mutual

Unslashed Finance

Neptune Mutual

Etherisc

InsurAce

Bridge Mutual

Tidal Finance

Copper

Evertas

Opyn

The report provides a detailed analysis of these key players of the global decentralized insurance market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

➡️𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠:

https://www.alliedmarketresearch.com/purchase-enquiry/A74837

KEY BENEFITS FOR STAKEHOLDERS

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the decentralized insurance market analysis from 2022 to 2032 to identify the prevailing decentralized insurance market forecast.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the decentralized insurance market size segmentation assists to determine the prevailing decentralized insurance market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global decentralized insurance market trends, key players, market segments, application areas, and market growth strategies.

Decentralized Insurance Market Report Highlights

By End User

Businesses

Individuals

By Type

Life Insurance

Non-life Insurance

By Region

North America (U.S., Canada)

Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific)

LAMEA (Latin America, Middle East, Africa)

Key Market Players : Nexus Mutual, Opyn, Bridge Mutual, Neptune Mutual, Etherisc, Unslashed Finance, Tidal Finance, Copper, InsurAce, Evertas

➡️𝐁𝐮𝐲 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐞𝐝 𝐏𝐫𝐢𝐜𝐞 @

https://bit.ly/3WRRpkW

➡️𝐋𝐞𝐚𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 :

Saudi Arabia Personal Loan Market https://www.alliedmarketresearch.com/saudi-arabia-personal-loan-market-A74407

Road Assistance Insurance Market https://www.alliedmarketresearch.com/road-assistance-insurance-market-A31872

WealthTech Solutions Market https://www.alliedmarketresearch.com/wealthtech-solutions-market-A31614

Gadget Insurance Market https://www.alliedmarketresearch.com/gadget-insurance-market-A11629

Tax Advisory Services Market https://www.alliedmarketresearch.com/tax-advisory-services-market-A31503

https://www.globenewswire.com/news-release/2023/06/07/2683865/0/en/Decentralized-Insurance-Market-to-Reach-135-6-Billion-Globally-by-2032-at-58-5-CAGR-Allied-Market-Research.html

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Decentralized Insurance Market to Reach $135.6 Billion, Globally, by 2032 at 58.5% CAGR : Unleashing Growth here

News-ID: 3455441 • Views: …

More Releases from www.alliedmarketresearch.com

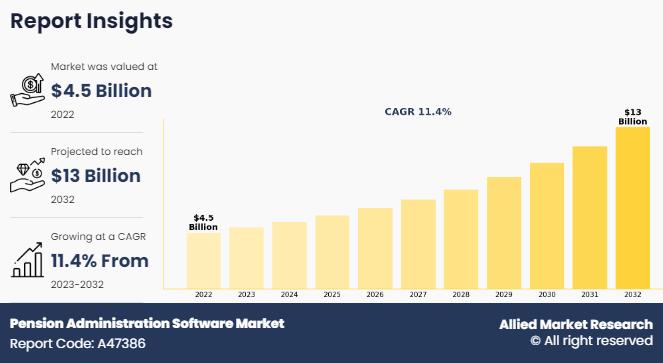

Pension Administration Software Market to Hit $12.2 Billion by 2031 | Unlocking …

The global pension administration software market was valued at $4.5 billion in 2022, and is projected to reach $13 billion by 2032, growing at a CAGR of 11.4% from 2023 to 2032.

➡️𝐁𝐮𝐲 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐞𝐝 𝐏𝐫𝐢𝐜𝐞 @ https://www.alliedmarketresearch.com/checkout-final/c2065f02c6664a057234507efd0ae343?utm_source=AMR&utm_medium=research&utm_campaign=P19623

The report provides a detailed analysis of the top investment pockets, winning strategies, drivers & opportunities, market size & estimations, competitive landscape, and evolving market trends. The market study is a helpful…

Digital Lending Market Set to Skyrocket to $71.8 Billion Globally by 2032 at 19. …

Allied Market Research published a report, titled, "Digital Lending Market by Component (Solution and Service) Deployment Mode (On-premises and Cloud) Enterprise Size (Large Enterprises and Small and Medium-sized Enterprises) End User (Banks, NBFCs, Credit Unions): Global Opportunity Analysis and Industry Forecast, 2023-2032". According to the report, the global digital lending industry generated $12.6 billion in 2022, and is anticipated to generate $71.8 billion by 2032, witnessing a CAGR of 19.4%…

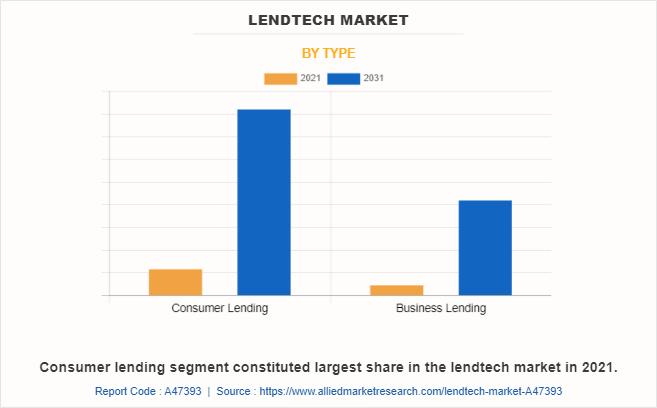

LendTech Market on the Rise: Expected to Hit $61.9 Billion Globally by 2031 at a …

Allied Market Research published a report, titled, "LendTech Market by Component (Solution and Services), Deployment Mode (On-Premises and Cloud), Type (Consumer Lending and Business Lending), Organization Size (Large Enterprises and Small and Medium-sized Enterprises), and End User (Banks, Insurance Companies, Credit Unions and NBFCs) And Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031"

➡️𝐁𝐮𝐲 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐞𝐝 𝐏𝐫𝐢𝐜𝐞 @ https://www.alliedmarketresearch.com/checkout-final/e9cfd6561c2455a97d15b253328e9309?utm_source=AMR&utm_medium=research&utm_campaign=P19623

According to the report,…

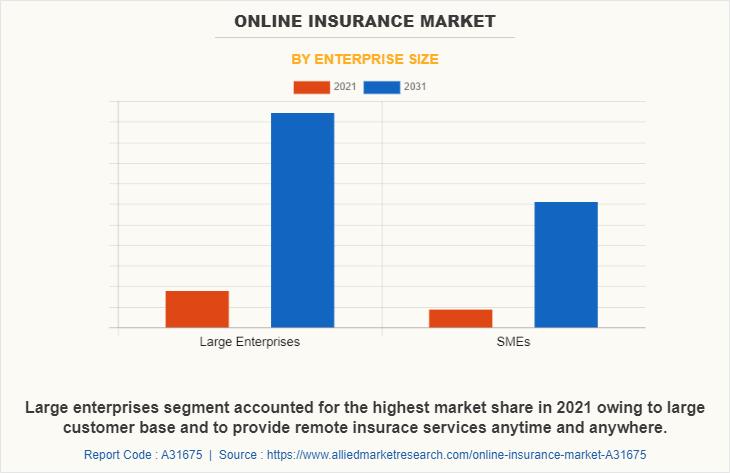

Online Insurance Market Set to Soar: Projected to Hit $330.1 Billion by 2031 | a …

According to the report published by Allied Market Research, the global online insurance market generated $53.2 billion in 2021, and is projected to reach $330.1 billion by 2031, growing at a CAGR of 20.2% from 2022 to 2031.

➡️𝐁𝐮𝐲 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐞𝐝 𝐏𝐫𝐢𝐜𝐞 @

https://www.alliedmarketresearch.com/checkout-final/37f5061b3aae7b2dcea8ce34b1176b6c?utm_source=AMR&utm_medium=research&utm_campaign=P19623

The report offers a detailed analysis of the top winning strategies, evolving market trends, market size and estimations, value chain, key investment pockets, drivers & opportunities,…

More Releases for Insurance

Household Insurance market by top keyaplayers - Discount Insurance Home Insuran …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance marketgrowth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market have also been included in…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Non-Life Insurance Market :Health Insurance, Property Insurance, Cargo Insurance …

Non-Life Insurance Market Overview:

Summary:Excellence consistency maintains by Garner Insights in Research Report in which studies the global Non-Life Insurance market status and forecast, categorizes and Equipment market value by manufacturers, type, application, and region.

Get Access to Report Sample: http://bit.ly/2Q9Hd8z

Non-Life Insurance market was valued at Million US$ in 2017 and is projected to reach Million US$ by 2025, at a CAGR of during the forecast period. In this study, 2017 has been…

Agricultural Insurance Market 2018-2023: AnHua Agricultural Insurance, Anxin Agr …

A new research study titled, “Global Agricultural Insurance Market” has been added to the comprehensive repository of Orbis Research

Agricultural Insurance Market - Global Status and Trend Report 2018-2023 offer a comprehensive analysis of the Agricultural Insurance industry, standing on the readers’ perspective, delivering detailed market data and penetrating insights. No matter the client is the industry insider, potential entrant or investor, the report will provide useful data and information.

The…

Insurance Market-Saga’s Retail Broking Business Offers Motor Insurance, Pet In …

Orbis Research Market brilliance released a new research report of 33 pages on title ‘Insurance Company Profile: Saga’ with detailed analysis, forecast and strategies.

Insurance Company Profile: Saga", profile provides a comprehensive review of Saga and its UK business. This includes its strategy for growth and focus on digitization as well as its performance in the UK and marketing and distribution strategy.

Request a sample of this report at http://orbisresearch.com/contacts/request-sample/2026595

Saga…