Press release

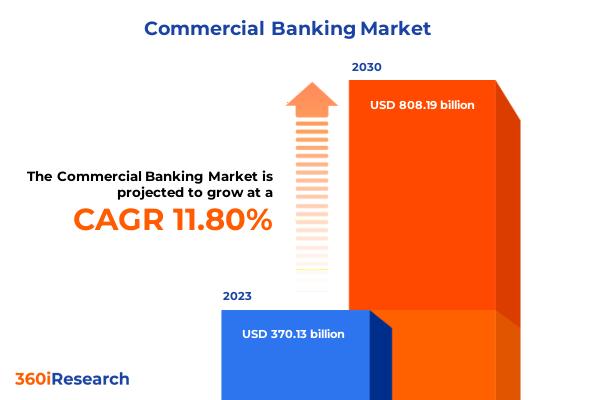

Commercial Banking Market worth $808.19 billion by 2030, growing at a CAGR of 11.80% - Exclusive Report by 360iResearch

The "Commercial Banking Market by Product (Capital Market, Commercial Lending, Project Finance), Application (Construction, Healthcare, Media & Entertainment) - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.The Global Commercial Banking Market to grow from USD 370.13 billion in 2023 to USD 808.19 billion by 2030, at a CAGR of 11.80%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/commercial-banking?utm_source=openpr&utm_medium=referral&utm_campaign=sample

Commercial banking includes providing business loans, savings, and checking accounts, and other financial products tailored to meet the needs of companies rather than individuals. Commercial banks play a pivotal role in the economic development of a country by facilitating business operations, supporting entrepreneurship, and enhancing the overall financial stability of the business sector. The expansion of businesses across borders increases the demand for various financial services, including foreign exchange, trade financing, and international payment processing, further driving the growth of commercial banking. Favorable regulations and government support encourage the growth of commercial banking by creating a conducive environment for its operations. The rising development of new financial products and services that enable banks to meet the evolving needs of businesses is leading to the expansion of commercial banking. As businesses become more sophisticated, their financial needs become more complex, pushing commercial banks to expand their offerings. Operational risks and regulatory challenges associated with commercial banking hamper the market growth. The adoption of new technologies in banking processes improves efficiency, customer service, and accessibility is expected to create opportunities for the market.

In the Americas region, the highly developed commercial banking systems are characterized by the presence of sophisticated financial products and technologies. The U.S., in particular, is home to some of the world's largest commercial banks, offering a wide range of services to businesses of all sizes. South America, while more varied, has seen significant growth in commercial banking, driven by increasing economic stability and integration into global markets. Countries, including Brazil and Mexico, feature prominent commercial banking sectors that play vital roles in their economies. The Asia-Pacific region is noted for its dynamic commercial banking sector, marked by rapid growth, innovation, and a competitive market environment. This region hosts a mix of mature, emerging, and frontier markets. Countries such as Australia and Japan have highly developed banking systems, whereas nations including China and India are experiencing swift expansion and technological adoption in their banking services. Southeast Asian countries, including Indonesia, Thailand, and Vietnam, are emerging as significant countries in the commercial banking sector, fueled by strong economic growth and increasing financial inclusion. The EMEA region encompasses a vast array of banking environments, from the highly developed markets of Western Europe to the emerging economies in Africa and the Middle East. In Europe, countries such as the United Kingdom, Germany, and France have sophisticated commercial banking sectors that serve as key components of the global financial system. The Middle East, while traditionally more focused on investment banking, has seen a rise in commercial banking activities, partly due to economic diversification efforts. Africa's commercial banking landscape is diverse, with South Africa and Nigeria leading in terms of market development.

Market Segmentation & Coverage:

This research report categorizes the Commercial Banking Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Product, market is studied across Capital Market, Commercial Lending, Project Finance, Syndicated Loans, and Treasury Management. The Capital Market is projected to witness significant market share during forecast period.

Based on Application, market is studied across Construction, Healthcare, Media & Entertainment, and Transportation & Logistics. The Construction is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 41.43% in 2023, followed by Europe, Middle East & Africa.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/commercial-banking?utm_source=openpr&utm_medium=referral&utm_campaign=inquire

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Commercial Banking Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Commercial Banking Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Commercial Banking Market, highlighting leading vendors and their innovative profiles. These include Axis Bank Limited, Bank of America Corporation, Barclays Bank PLC, BNP Paribas, Busey Bank, Capital One Financial Corp., China Construction Bank, Citigroup Inc., Crédit Agricole S.A., Goldman Sachs & Co. LLC, HDFC Bank Limited, HSBC Holdings PLC, ICBC Co., Ltd., ICICI Bank Limited, JPMorgan Chase & Co., Kotak Mahindra Bank Limited, Morgan Stanley & Co. LLC, Royal Bank of Canada, Santander Bank, N. A, Standard Chartered PLC, TD Bank, N.A., The Bank of New York Mellon Corporation, The PNC Financial Services Group, Inc., U.S. Bank, and Wells Fargo & Company.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Commercial Banking Market, by Product

7. Commercial Banking Market, by Application

8. Americas Commercial Banking Market

9. Asia-Pacific Commercial Banking Market

10. Europe, Middle East & Africa Commercial Banking Market

11. Competitive Landscape

12. Competitive Portfolio

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Commercial Banking Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Commercial Banking Market?

3. What is the competitive strategic window for opportunities in the Commercial Banking Market?

4. What are the technology trends and regulatory frameworks in the Commercial Banking Market?

5. What is the market share of the leading vendors in the Commercial Banking Market?

6. What modes and strategic moves are considered suitable for entering the Commercial Banking Market?

Read More @ https://www.360iresearch.com/library/intelligence/commercial-banking?utm_source=openpr&utm_medium=referral&utm_campaign=analyst

Contact 360iResearch

Mr. Ketan Rohom

Sales & Marketing,

Office No. 519, Nyati Empress,

Opposite Phoenix Market City,

Vimannagar, Pune, Maharashtra,

India - 411014.

sales@360iresearch.com

+1-530-264-8485

+91-922-607-7550

About 360iResearch

360iResearch is a market research and business consulting company headquartered in India, with clients and focus markets spanning the globe.

We are a dynamic, nimble company that believes in carving ambitious, purposeful goals and achieving them with the backing of our greatest asset - our people.

Quick on our feet, we have our ear to the ground when it comes to market intelligence and volatility. Our market intelligence is diligent, real-time and tailored to your needs, and arms you with all the insight that empowers strategic decision-making.

Our clientele encompasses about 80% of the Fortune Global 500, and leading consulting and research companies and academic institutions that rely on our expertise in compiling data in niche markets. Our meta-insights are intelligent, impactful and infinite, and translate into actionable data that support your quest for enhanced profitability, tapping into niche markets, and exploring new revenue opportunities.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Commercial Banking Market worth $808.19 billion by 2030, growing at a CAGR of 11.80% - Exclusive Report by 360iResearch here

News-ID: 3441283 • Views: …

More Releases from 360iResearch

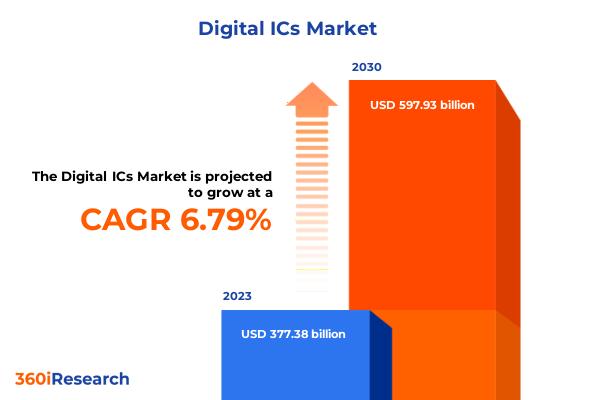

Digital ICs Market worth $597.93 billion by 2030, growing at a CAGR of 6.79% - E …

The "Digital ICs Market by Type (Application Specific, General Purpose), Category (Comparators, Digital Signal Processors, Memory), End-User - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/digital-ics?utm_source=openpr&utm_medium=referral&utm_campaign=sample

"Key Drivers Shaping the Growth of the Digital Integrated Circuits Market"

The digital integrated circuits (IC) market is experiencing robust growth, propelled by several key factors. The burgeoning demand for consumer electronics like smartphones and tablets, which depend…

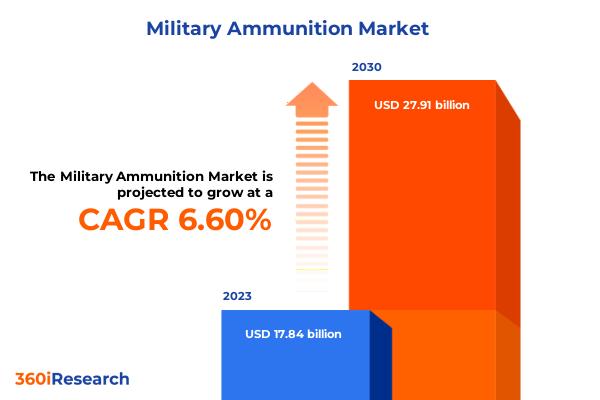

Military Ammunition Market worth $27.91 billion by 2030, growing at a CAGR of 6. …

The "Military Ammunition Market by Product (Artillery Shell, Bomb, Bullet), Lethality (Less-lethal, Lethal), Guidance, Platform - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/military-ammunition?utm_source=openpr&utm_medium=referral&utm_campaign=sample

"Key Trends Shaping the Growth of the Global Military Ammunition Market"

As governments around the world increase their defense budgets in response to rising geopolitical tensions, there is a corresponding growth in the military ammunition market. Countries are investing in…

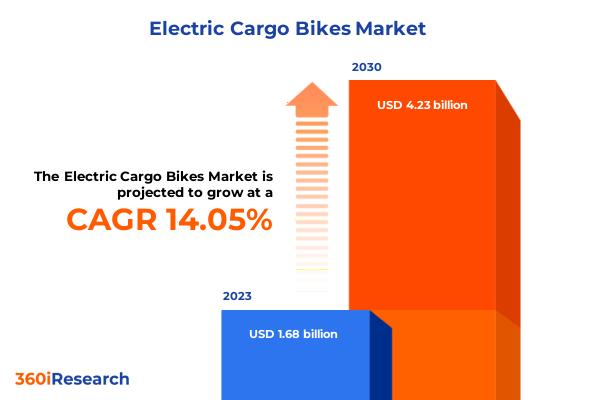

Electric Cargo Bikes Market worth $4.23 billion by 2030, growing at a CAGR of 14 …

The "Electric Cargo Bikes Market by Battery Type (Lead-Based, Lithium Ion, Nickel Based), Application (Commercial, Personal) - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/electric-cargo-bikes?utm_source=openpr&utm_medium=referral&utm_campaign=sample

"Urban Innovation and Environmental Responsibility Drive the Rise of Electric Cargo Bikes"

As cities expand, the demand for efficient and eco-friendly urban delivery solutions like electric cargo bikes is escalating. These bikes excel in navigating congested streets, thereby accelerating…

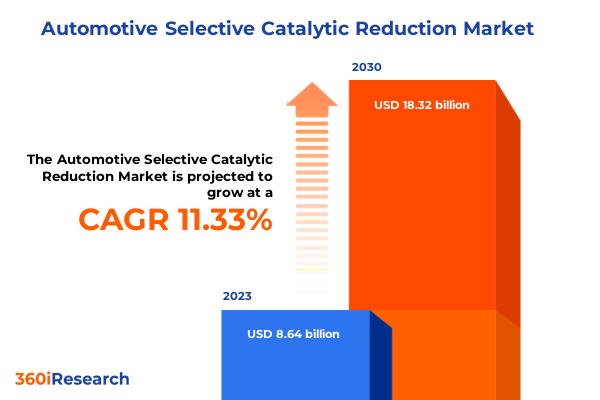

Automotive Selective Catalytic Reduction Market worth $18.32 billion by 2030, gr …

The "Automotive Selective Catalytic Reduction Market by Component (Engine Control Unit (ECU), Injector, Urea Pump), Catalyst Type (Copper, Iron), Fuel Type, Vehicle Type - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/automotive-selective-catalytic-reduction?utm_source=openpr&utm_medium=referral&utm_campaign=sample

"Driving Sustainability: Key Factors Propelling the Growth of Automotive Selective Catalytic Reduction (SCR) Technology"

The selective catalytic reduction (SCR) market is experiencing substantial growth driven by increasing demands for low-emission diesel vehicles,…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

What's driving the Neo and Challenger Bank Market trends? Key Players are Hello …

This Global Neo and Challenger Bank market report studies the industry based on one or more segments covering key players, types, applications, products, technology, end-users, and regions for historical data as well as provides forecasts for next few years.

The global Neo and Challenger Bank market is highly competitive and fragmented due to the presence of numerous small vendors in the market. Atom Bank, WeBank (Tencent Holdings Limited), N26, Starling Bank…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…