Press release

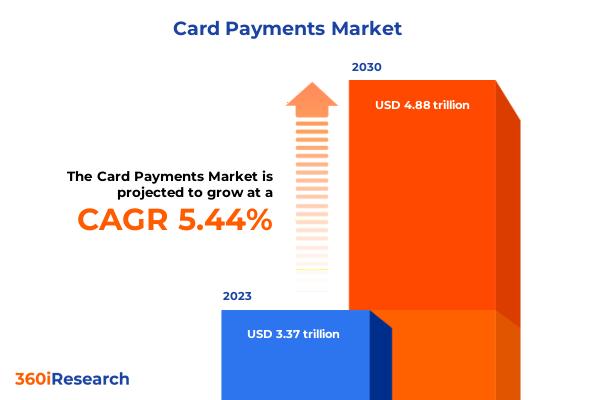

Card Payments Market worth $4.88 trillion by 2030, growing at a CAGR of 5.44% - Exclusive Report by 360iResearch

The "Card Payments Market by Type of Cards (Charge Cards, Credit Cards, Debit Cards), Technology (Chip Cards (EMV), Contactless Cards, Magnetic Stripe Cards), Application, Transaction Environment - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.The Global Card Payments Market to grow from USD 3.37 trillion in 2023 to USD 4.88 trillion by 2030, at a CAGR of 5.44%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/card-payments?utm_source=openpr&utm_medium=referral&utm_campaign=sample

Card payments refer to financial transactions wherein the payer uses a debit, credit, or prepaid card issued by a banking institution or financial services company to transfer funds to the payee. These transactions can be conducted in person, through point-of-sale (POS) terminals, online, or via mobile devices. Card payments facilitate instant payments and settlements, reducing the necessity for carrying physical cash and streamlining purchasing goods and services. Applications of card payments span across diverse sectors, including retail, eCommerce, banking, finance, healthcare, transportation, and government services, among others. End-users are broadly classified into individual consumers, businesses, and government entities, leveraging card payments for transactions ranging from routine purchases to large-scale procurement processes. Key factors driving the growth of the card payments market include advancements in technology, increasing global internet penetration, proliferation of eCommerce platforms, rising trend of mobile payments, and evolving consumer preferences towards cashless transactions. Regulatory support and initiatives promoting financial inclusion further accelerate the adoption of card-based payments across various demographics. However, the market faces challenges such as cybersecurity threats, privacy concerns, regulatory compliance requirements, and the risk of fraud. On the other hand, integrating blockchain for enhanced security, adopting contactless payment solutions, and developing biometric authentication mechanisms present notable opportunities within the card payments market. Expansion in emerging economies, where cash transactions still predominate, also offers significant growth prospects.

In North America, particularly the United States, the card payments market is developing, with a high penetration rate of credit and debit cards. High consumer adoption driven by convenience, rewards programs, and a robust eCommerce ecosystem further drives the market in the region. In South America, Brazil is at the forefront of embracing digital payments, including card payments, fueled by a growing fintech sector. The European card payments market is highly diverse, with Western Europe displaying a strong push towards cashless transactions facilitated by robust infrastructure and regulatory support. The adoption of EMV technology and the growth of NFC-enabled devices have bolstered contactless payments. In Eastern Europe, while the transition to cashless payments is ongoing, card usage is growing, particularly with international card schemes gaining traction. The Middle East is witnessing rapid growth in card payments, underpinned by a young and tech-savvy population and concerted efforts from governments to transition to a cashless society. Africa presents a dynamic market with significant variances across regions. While card payment infrastructure is still developing, there are considerable investments in mobile payment solutions that integrate card platforms. The APAC region is witnessing a dynamic shift towards digital payments, with China and India directing the transition. China is at the forefront of the card payment segment with a massive adoption of digital wallets and QR code payments. Japan's card payment industry is characterized by high security and consumer protection levels, with a steady increase in contactless and mobile payments. India is witnessing a digital payment revolution, with card payments playing a crucial role alongside mobile wallets and UPI (Unified Payments Interface). Government initiatives, including the Digital India campaign and the launch of RuPay, a domestic card scheme, signify a significant push towards achieving financial inclusion and a cashless economy.

Market Segmentation & Coverage:

This research report categorizes the Card Payments Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Type of Cards, market is studied across Charge Cards, Credit Cards, Debit Cards, and Prepaid Cards. The Debit Cards is projected to witness significant market share during forecast period.

Based on Technology, market is studied across Chip Cards (EMV), Contactless Cards, and Magnetic Stripe Cards. The Magnetic Stripe Cards is projected to witness significant market share during forecast period.

Based on Application, market is studied across Consumer Electronics, Healthcare & Pharmacy, Media & Entertainment, Restaurants & Bars, Retail, and Travel & Tourism. The Media & Entertainment is projected to witness significant market share during forecast period.

Based on Transaction Environment, market is studied across Online Transactions and Point of Sale (POS). The Point of Sale (POS) is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Europe, Middle East & Africa commanded largest market share of 35.67% in 2023, followed by Americas.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/card-payments?utm_source=openpr&utm_medium=referral&utm_campaign=inquire

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Card Payments Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Card Payments Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Card Payments Market, highlighting leading vendors and their innovative profiles. These include Adyen N.V., American Express Company, AU Small Finance Bank, Bank of America Corporation, Barclays Bank Delaware, Block, Inc., BNP Paribas S.A., Capital One Financial Corporation, Cardless, Inc., Citigroup Inc., Deutsche Bank AG, First Abu Dhabi Bank PJSC, Fiserv, Inc., Hongkong and Shanghai Banking Corporation Limited, JCB Co., Ltd., JPMorgan Chase group, Marqeta, Inc., Mastercard International Incorporated, PayPal Payments Private Limited, Revolut Ltd, Stripe, Inc., Synchrony Bank, UnionPay International Co. Ltd., Visa Inc., and Wells Fargo Bank, N.A..

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Card Payments Market, by Type of Cards

7. Card Payments Market, by Technology

8. Card Payments Market, by Application

9. Card Payments Market, by Transaction Environment

10. Americas Card Payments Market

11. Asia-Pacific Card Payments Market

12. Europe, Middle East & Africa Card Payments Market

13. Competitive Landscape

14. Competitive Portfolio

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Card Payments Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Card Payments Market?

3. What is the competitive strategic window for opportunities in the Card Payments Market?

4. What are the technology trends and regulatory frameworks in the Card Payments Market?

5. What is the market share of the leading vendors in the Card Payments Market?

6. What modes and strategic moves are considered suitable for entering the Card Payments Market?

Read More @ https://www.360iresearch.com/library/intelligence/card-payments?utm_source=openpr&utm_medium=referral&utm_campaign=analyst

Contact 360iResearch

Mr. Ketan Rohom

Sales & Marketing,

Office No. 519, Nyati Empress,

Opposite Phoenix Market City,

Vimannagar, Pune, Maharashtra,

India - 411014.

sales@360iresearch.com

+1-530-264-8485

+91-922-607-7550

About 360iResearch

360iResearch is a market research and business consulting company headquartered in India, with clients and focus markets spanning the globe.

We are a dynamic, nimble company that believes in carving ambitious, purposeful goals and achieving them with the backing of our greatest asset - our people.

Quick on our feet, we have our ear to the ground when it comes to market intelligence and volatility. Our market intelligence is diligent, real-time and tailored to your needs, and arms you with all the insight that empowers strategic decision-making.

Our clientele encompasses about 80% of the Fortune Global 500, and leading consulting and research companies and academic institutions that rely on our expertise in compiling data in niche markets. Our meta-insights are intelligent, impactful and infinite, and translate into actionable data that support your quest for enhanced profitability, tapping into niche markets, and exploring new revenue opportunities.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Card Payments Market worth $4.88 trillion by 2030, growing at a CAGR of 5.44% - Exclusive Report by 360iResearch here

News-ID: 3437409 • Views: …

More Releases from 360iResearch

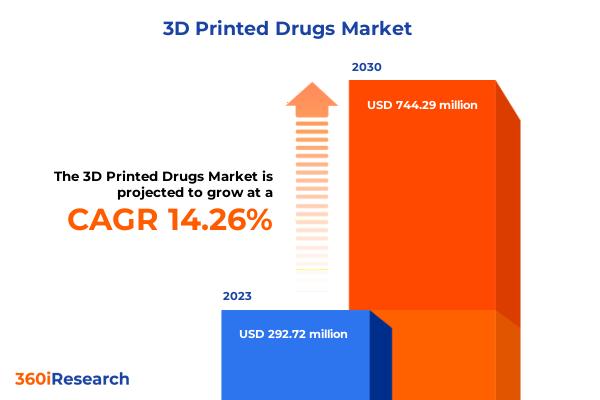

3D Printed Drugs Market worth $744.29 million by 2030, growing at a CAGR of 14.2 …

The "3D Printed Drugs Market by Technology (Direct-Write, Fused Deposition Modelling, Inkjet Printing), Dose Form (Capsule, Nanoparticles, Tablet), Application, End-User - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/3d-printed-drugs?utm_source=openpr&utm_medium=referral&utm_campaign=sample

"3D Printed Drugs Market Poised for Expansion Amidst Rising Customization Demand and Regulatory Support"

The 3D printed drugs market is experiencing robust growth driven by multiple factors. Key drivers include the ability to customize medications…

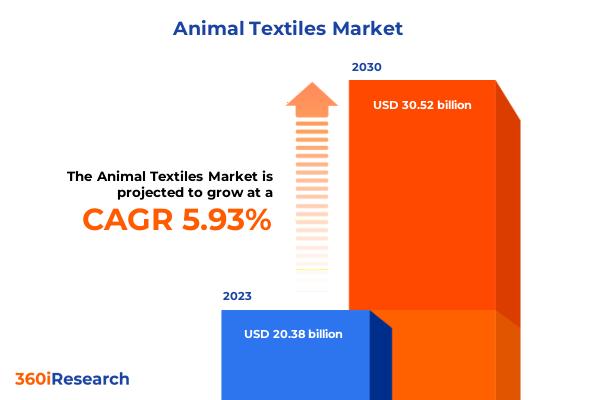

Animal Textiles Market worth $30.52 billion by 2030, growing at a CAGR of 5.93% …

The "Animal Textiles Market by Type (Animal wool, Silk), Application (Apparel, Home Textiles, Industrial Textiles) - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/animal-textiles?utm_source=openpr&utm_medium=referral&utm_campaign=sample

"Key Drivers Fueling Growth in the Animal Textiles Market"

The animal textiles market is experiencing significant growth, driven by several key factors. Demand in the fashion and apparel industries remains high for materials like wool, silk, and leather due to…

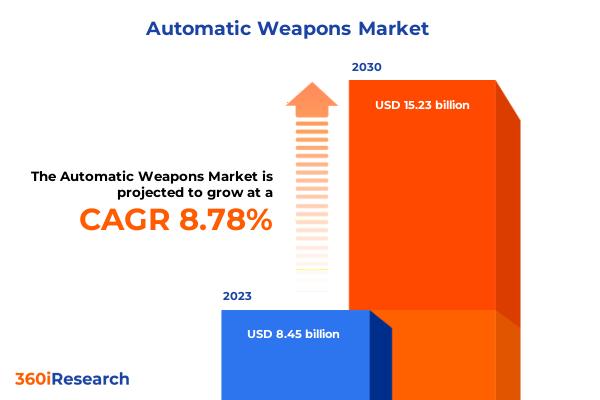

Automatic Weapons Market worth $15.23 billion by 2030, growing at a CAGR of 8.78 …

The "Automatic Weapons Market by Product (Automatic Cannons, Automatic Launchers, Automatic Rifles), Type (Fully Automatic, Semi-Automatic), Caliber, End User - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/automatic-weapons?utm_source=openpr&utm_medium=referral&utm_campaign=sample

"Key Drivers Fueling the Growth of the Global Automatic Weapons Market"

The global automatic weapons market is experiencing significant growth, driven by several key factors. Rising demand within the defense and law enforcement sectors is a…

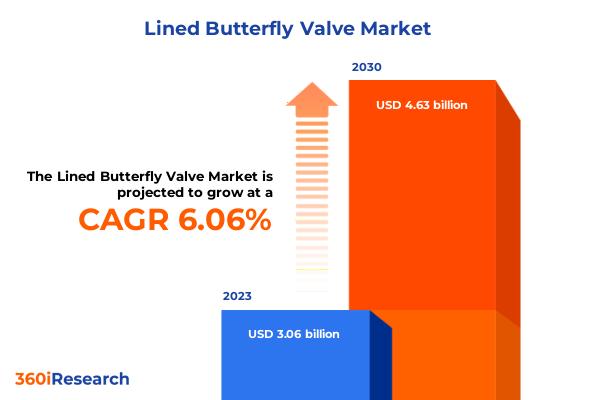

Lined Butterfly Valve Market worth $4.63 billion by 2030, growing at a CAGR of 6 …

The "Lined Butterfly Valve Market by Material (Fluorinated Ethylene Propylene Lined Butterfly Valves, Perfluoroalkoxy Lined Butterfly Valves, Polytetrafluoroethylene Lined Butterfly Valves), Mechanism (Centric Valves, Eccentric Valves), Applications, Function, Installation, End-User Industries, Sales Channel - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/lined-butterfly-valve?utm_source=openpr&utm_medium=referral&utm_campaign=sample

"Growing Demand and Strategic Collaborations Propel Lined Butterfly Valve Market"

The global market for lined butterfly valves is experiencing substantial growth, driven…

More Releases for Card

Gift Card and Incentive Card Market Set for Explosive Growth | National Gift Car …

A new business intelligence report released by AMA with title "Gift Card and Incentive Card Market" has abilities to raise as the most significant market worldwide as it has remained playing a remarkable role in establishing progressive impacts on the universal economy. The Global Gift Card and Incentive Card Market Report offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through…

IC Card/Smart Card Market 2022 | Detailed Report

The IC Card/Smart Card research report combines vital data incorporating the competitive landscape, global, regional, and country-specific market size, market growth analysis, market share, recent developments, and market growth in segmentation. Furthermore, the IC Card/Smart Card research report offers information and thoughtful facts like share, revenue, historical data, and global market share. It also highlights vital aspects like opportunities, driving, product scope, market overview, and driving force.

Download FREE Sample Report…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future.

A new report published by Allied Market Research, titled, Prepaid Card Market…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future

Prepaid Card Market is projected to grow at a CAGR of 22.7%…

Card Intelligent Lock Market Report 2018: Segmentation by Type (Magnetic card Lo …

Global Card Intelligent Lock market research report provides company profile for Tri-circle, Dessmann, Royalwand, Bangpai, ZKTeco, Schlage, KEYLOCK, Yale, Tenon, KAADAS, BE-TECH and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also…

Prepaid Card Market Report 2018: Segmentation by Card Type (Single-purpose prepa …

Global Prepaid Card market research report provides company profile for Green Dot Corporation, NetSpend Holdings, Inc., H&R Block Inc., American Express Company, JPMorgan Chase & Co., PayPal Holdings, Inc., BBVA Compass Bancshares, Inc. and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and…