Press release

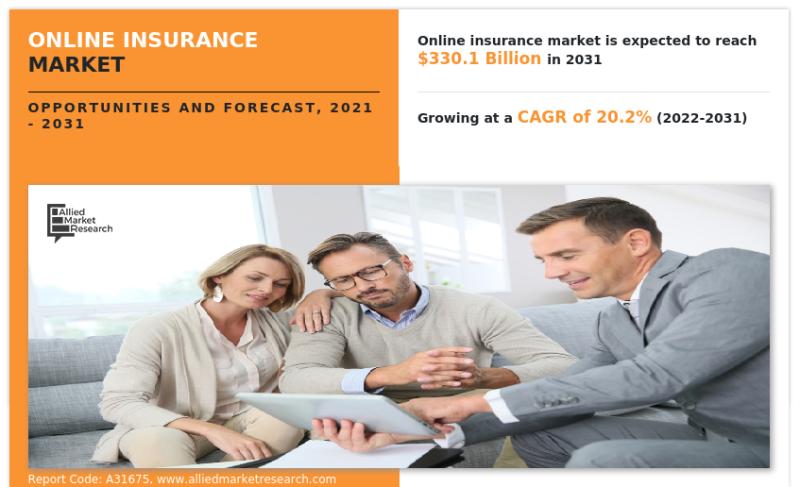

Online Insurance Market : Estimated to Lock an Ineffaceable Growth Through 2031 | At a CAGR of 20.2%

According to the report published by Allied Market Research, the global online insurance market generated $53.2 billion in 2021, and is projected to reach $330.1 billion by 2031, growing at a CAGR of 20.2% from 2022 to 2031. The report offers a detailed analysis of the top winning strategies, evolving market trends, market size and estimations, value chain, key investment pockets, drivers & opportunities, competitive landscape, and regional landscape. The report is a useful source of information for new entrants, shareholders, frontrunners, and shareholders in introducing necessary strategies for the future and taking essential steps to significantly strengthen and heighten their position in the market.𝑹𝒆𝒒𝒖𝒆𝒔𝒕 𝑺𝒂𝒎𝒑𝒍𝒆 𝑪𝒐𝒑𝒚 𝒐𝒇 𝑹𝒆𝒑𝒐𝒓𝒕-: https://www.alliedmarketresearch.com/request-sample/32125

COVID-19 Scenario:

The outbreak of the COVID-19 pandemic had a positive impact on the growth of the global online insurance market, due to surging demand for reinforcing remote access methods.

Growing need for regrouping and redesigning operational solutions for fulfilling demand of policy holders through online tool.

Interested to Procure the Data? Inquire Here (Get Full Insights in PDF - 173+ Pages) @

https://www.alliedmarketresearch.com/purchase-enquiry/32125

The report offers a detailed segmentation of the global online insurance market based on enterprise size, insurance type, end user, and region. The report provides a comprehensive analysis of every segment and their respective sub-segment with the help of graphical and tabular representation. This analysis can essentially help market players, investors, and new entrants in determining and devising strategies based on the fastest-growing segments and highest revenue generation that is mentioned in the report.

Based on enterprise size, the large enterprises segment held the major market share in 2021, holding more than two-thirds of the global online insurance market share, and is expected to maintain its leadership status during the forecast period. However, the SMEs segment, is expected to cite the fastest CAGR of 21.5% during the forecast period.

On the basis of insurance type, the life insurance segment held the largest market share in 2021, accounting for more than half of the global online insurance market share, and is expected to maintain its leadership status during the forecast period. Nevertheless, the health insurance segment, is expected to cite the highest CAGR of 22.6% during the forecast period.

In terms of end user, the insurance companies segment held the largest market share in 2021, accounting for half of the global online insurance market share. Furthermore, the same segment is expected to maintain its leadership status during the forecast period. Nevertheless, the third party administrators brokers segment, is expected to cite the highest CAGR of 21.8% during the forecast period.

Region-wise, the North American region held the major market share in 2021, grabbing nearly two-fifths of the global online insurance market share. Moreover, the North American market is slated to dominate the global market share during the forecast period. In addition, the Asia-Pacific region is expected to cite the fastest CAGR of 22.2% during the forecast period. The report also analyses other regions such as Europe and LAMEA.

The key players analyzed in the global online insurance market report includes Allianz SE, assicurazioni generali spa, AXA Group, Munich Re, Swiss Re, Aviva, Zurich Insurance Group, Esurance Insurance Services, Inc, Lemonade, Inc., and RooT

The report analyzes these key players in the global online insurance market. These market players have made effective use of strategies such as joint ventures, collaborations, expansion, new product launches, partnerships, and others to maximize their foothold and prowess in the industry. The report is helpful in analyzing recent developments, product portfolio, business performance, and operating segments by prominent players in the market.

KEY BENEFITS FOR STAKEHOLDERS

➧The study provides an in-depth analysis of the online insurance market forecast along with current & future trends to explain the imminent investment pockets.

➧Information about key drivers, restraints, & opportunities and their impact analysis on global online insurance market trends is provided in the report.

➧The Porter's five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

➧The online insurance market analysis from 2022 to 2031 is provided to determine the market potential.

Key Market Segments

Enterprise Size

➧Large Enterprises

➧SMEs

Insurance type

➧Life Insurance

➧Motor Insurance

➧Health Insurance

➧Others

End User

➧Insurance Companies

➧Aggregators

➧Third Party Administrators and Brokers

By Region

➧North America (U.S., Canada)

➧Europe (UK, Germany, France, Spain, Italy, Rest of Europe)

➧Asia-Pacific (China, Japan, South Korea, India, Australia, Rest of Asia-Pacific)

➧LAMEA (Latin America, Middle East, Africa)

Buy This Research Report - https://bit.ly/3TTEXhu

Top Trending Reports:

1.Syndicated Loans Market: https://www.alliedmarketresearch.com/syndicated-loans-market-A31434

2.Reinsurance Market: https://www.alliedmarketresearch.com/reinsurance-market-A06288

3.Real-Time Payments Market: https://www.alliedmarketresearch.com/real-time-payments-market-A19437

4.Factoring Services Market: https://www.alliedmarketresearch.com/factoring-services-market-A17187

5.Pet Insurance Market: https://www.alliedmarketresearch.com/pet-insurance-market

6.Financial Guarantee Market: https://www.alliedmarketresearch.com/financial-guarantee-market-A14515

Contact:

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Online Insurance Market : Estimated to Lock an Ineffaceable Growth Through 2031 | At a CAGR of 20.2% here

News-ID: 3261904 • Views: …

More Releases from Allied Market Research

Sustainable Tourism Market Size Worth USD 11.4 trillion By 2032 | Growth Opportu …

According to a new report published by Allied Market Research, titled, "Sustainable Tourism Market" The report provides a detailed analysis of the top investment pockets, top winning strategies, drivers & opportunities, market size & estimations, competitive landscape, and changing market trends. In 2023, the coastal tourism segment occupied the largest market share as it is one of the most popular types of sustainable tourism locations in the world due to…

Dermocosmetics Market is slated to increase at a CAGR of 11.1% to reach a valuat …

The global Dermocosmetics market size was valued at $51.10 billion in 2021, and is projected to reach $130.46 billion by 2030, growing at a CAGR of 11.1% from 2022 to 2030. The Dermocosmetics Market report defines and outlines the products, applications, and specifications to the reader. The study lists the leading companies operating in the Market and highlights the key change processes that companies have adopted to maintain their strengths.…

Vegan Cosmetics Market is slated to increase at a CAGR of 5.9% to reach a valuat …

According to a new report published by Allied Market Research, titled, "Vegan Cosmetics Market," The vegan cosmetics market size was valued at $16.6 billion in 2021, and is estimated to reach $28.5 billion by 2031, growing at a CAGR of 5.9% from 2022 to 2031.

➡️𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/16708

Vegan cosmetics are made up of chemical compounds taken from natural or synthetic sources that do not contain any…

Astrology Market Accelerate at 5.7% CAGR , USD 22.8 billion Incremental Growth

According to the report published by Allied Market Research, the global astrology market has witnessed growth valued at $12.8 billion in 2021, and is projected to reach $22.8 billion by 2031, registering a CAGR of 5.7% from 2023 to 2032. This report analyses the market dynamics, futuristic trends & developments, and segmentation overview.

➡️𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/32229

• Online Platforms and mobile apps provide wider access

Technology makes astrology…

More Releases for Insurance

Household Insurance market by top keyaplayers - Discount Insurance Home Insuran …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance marketgrowth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market have also been included in…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Non-Life Insurance Market :Health Insurance, Property Insurance, Cargo Insurance …

Non-Life Insurance Market Overview:

Summary:Excellence consistency maintains by Garner Insights in Research Report in which studies the global Non-Life Insurance market status and forecast, categorizes and Equipment market value by manufacturers, type, application, and region.

Get Access to Report Sample: http://bit.ly/2Q9Hd8z

Non-Life Insurance market was valued at Million US$ in 2017 and is projected to reach Million US$ by 2025, at a CAGR of during the forecast period. In this study, 2017 has been…

Agricultural Insurance Market 2018-2023: AnHua Agricultural Insurance, Anxin Agr …

A new research study titled, “Global Agricultural Insurance Market” has been added to the comprehensive repository of Orbis Research

Agricultural Insurance Market - Global Status and Trend Report 2018-2023 offer a comprehensive analysis of the Agricultural Insurance industry, standing on the readers’ perspective, delivering detailed market data and penetrating insights. No matter the client is the industry insider, potential entrant or investor, the report will provide useful data and information.

The…

Insurance Market-Saga’s Retail Broking Business Offers Motor Insurance, Pet In …

Orbis Research Market brilliance released a new research report of 33 pages on title ‘Insurance Company Profile: Saga’ with detailed analysis, forecast and strategies.

Insurance Company Profile: Saga", profile provides a comprehensive review of Saga and its UK business. This includes its strategy for growth and focus on digitization as well as its performance in the UK and marketing and distribution strategy.

Request a sample of this report at http://orbisresearch.com/contacts/request-sample/2026595

Saga…