Press release

Factoring and Receivables Financing Market Is Booming Worldwide 2021-2027 | Barclays Bank PLC, BNP Paribas, China Construction Bank Corporation

Factoring and Receivables Financing Market Growing Popularity and Emerging TrendsGlobal Factoring and Receivables Financing market 2021-2027 in-depth study accumulated to supply latest insights concerning acute options. The report contains different predictions associated with Factoring and Receivables Financing market size, revenue, production, CAGR, consumption, profit margin, price, and different substantial factors. Whereas accentuation the key driving and Factoring and Receivables Financing restraining forces for this market, the report offers trends and developments. It additionally examines the role of the leading Factoring and Receivables Financing market players concerned within the business together with their company summary, monetary outline and SWOT analysis.

Some of the key players’ Analysis in Factoring and Receivables Financing Market Cell Point : Barclays Bank PLC, BNP Paribas, China Construction Bank Corporation, Deutsche Factoring Bank, Eurobank, Hitachi Capital (UK) PLC, HSBC Group, ICBC China, Kuke Finance., Mizuho Financial Group, and Inc.

GET SAMPLE COPY OF THIS REPORT: https://www.reportsandmarkets.com/sample-request/global-factoring-and-receivables-financing-market-4338536?utm_source=openpr&utm_medium=34

One of the crucial parts of this report comprises Factoring and Receivables Financing industry key vendor’s discussion about the brand’s summary, profiles, market revenue, and financial analysis. The report will help market players build future business strategies and discover worldwide competition. A detailed segmentation analysis of the market is done on producers, regions, type and applications in the report.

On the basis of geographically, the market report covers data points for multiple geographies such as United States, Europe, China, Japan, Southeast Asia, India, and Central& South America

Analysis of the market:

Other important factors studied in this report include demand and supply dynamics, industry processes, import & export scenario, R&D development activities, and cost structures. Besides, consumption demand and supply figures, cost of production, gross profit margins, and selling price of products are also estimated in this report.

Predominant Questions Answered in This Report Are:

Which segments will perform well in the Factoring and Receivables Financing market over the forecasted years?

In which markets companies should authorize their presence?

What are the forecasted growth rates for the market?

What are the long-lasting defects of the industry?

How share market changes their values by different manufacturing brands?

What are the qualities and shortcomings of the key players?

What are the major end results and effects of the five strengths study of industry?

The conclusion part of their report focuses on the existing competitive analysis of the market. We have added some useful insights for both industries and clients. All leading manufacturers included in this report take care of expanding operations in regions. Here, we express our acknowledgment for the support and assistance from the Factoring and Receivables Financing industry experts and publicizing engineers as well as the examination group’s survey and conventions. Market rate, volume, income, demand and supply data are also examined.

Table of contents:

Factoring and Receivables Financing Global Market Research Report 2021

Chapter 1: Factoring and Receivables Financing Market Overview, Product Overview, Market Segmentation, Market Overview of Regions, Market Dynamics, Limitations, Opportunities and Industry News and Policies.

Chapter 2: Factoring and Receivables FinancingIndustry Chain Analysis, Upstream Raw Material Suppliers, Major Players, Production Process Analysis, Cost Analysis, Market Channels, and Major Downstream Buyers.

Chapter 3:Value Analysis, Production, Growth Rate and Price Analysis by Type of Factoring and Receivables Financing .

Chapter 4:Downstream Characteristics, Consumption and Market Share by Application of Factoring and Receivables Financing .

Chapter 5:Production Volume, Price, Gross Margin, and Revenue ($) of Factoring and Receivables Financing by Regions.

Chapter 6: Factoring and Receivables Financing Production, Consumption, Export, and Import by Regions.

Chapter 7: Factoring and Receivables Financing Market Status and SWOT Analysis by Regions.

Chapter 8:Competitive Landscape, Product Introduction, Company Profiles, Market Distribution Status by Players of Factoring and Receivables Financing .

Chapter 9: Factoring and Receivables Financing Market Analysis and Forecast by Type and Application.

Chapter 10: Factoring and Receivables Financing Market Analysis and Forecast by Regions.

Chapter 11: Factoring and Receivables Financing Industry Characteristics, Key Factors, New Entrants SWOT Analysis, Investment Feasibility Analysis.

Chapter 12: Factoring and Receivables Financing Market Conclusion of the Whole Report.

To inquire about the Global Factoring and Receivables Financing market report, click here: https://www.reportsandmarkets.com/sample-request/global-factoring-and-receivables-financing-market-4338536?utm_source=openpr&utm_medium=34

About Us:

Reportsandmarkets.com is the most comprehensive collection of market research products and services on the Web. We offer reports from almost all top publishers and update our collection on daily basis to provide you with instant online access to the world’s most complete and recent database of expert insights on Global industries, organizations, products, and trends.

Contact Us:

Sanjay Jain

Manager – Partner Relations & International Marketing

www.reportsandmarkets.com

Ph: +1-352-353-0818 (US)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Factoring and Receivables Financing Market Is Booming Worldwide 2021-2027 | Barclays Bank PLC, BNP Paribas, China Construction Bank Corporation here

News-ID: 2345620 • Views: …

More Releases from REPORTSANDMARKETS

Micro Hotels Market Is Expected to Boom | Nine Hours in Japan, Dean Hotel Dublin …

This report studies the Micro Hotels Market with many aspects of the industry like the market size, market status, market trends and forecast, the report also provides brief information of the competitors and the specific growth opportunities with key market drivers. Find the complete Micro Hotels Market analysis segmented by companies, region, type and applications in the report.

New vendors in the market are facing tough competition from established international vendors…

IT Consulting and Integration Services Market Overview by Advance Technology, Fu …

This report studies the IT Consulting and Integration Services Market with many aspects of the industry like the market size, market status, market trends and forecast, the report also provides brief information of the competitors and the specific growth opportunities with key market drivers. Find the complete IT Consulting and Integration Services Market analysis segmented by companies, region, type and applications in the report.

The report offers valuable insight into the…

Bumping Services Market Growth, Overview with Detailed Analysis 2022-2028| ASE G …

This report studies the Bumping Services market with many aspects of the industry like the market size, market status, market trends and forecast, the report also provides brief information of the competitors and the specific growth opportunities with key market drivers. Find the complete Bumping Services market analysis segmented by companies, region, type and applications in the report.

New vendors in the market are facing tough competition from established international vendors…

Laser Powder Bed Fusion (LPBF) Technology Market Overview by Advance Technology, …

This report studies the Laser Powder Bed Fusion (LPBF) Technology market with many aspects of the industry like the market size, market status, market trends and forecast, the report also provides brief information of the competitors and the specific growth opportunities with key market drivers. Find the complete Laser Powder Bed Fusion (LPBF) Technology market analysis segmented by companies, region, type and applications in the report.

New vendors in the market…

More Releases for Factoring

Factoring Industry Summary By Forecat 2026 | Top Market Players Industry Partici …

Factoring Market Study Report

Factoring Market is Slated to Grow Substantially at 4.3 % CAGR During Forecast Period

A report by Straits Research on the Global Factoring Market research provides an in-depth examination on the latest market dynamics, including strengths, weaknesses, opportunities, and threats. After carrying out detailed assessment of the historical and present growth parameters of the market, the report provides business insights with utmost precision. The study then identifies specific…

Factoring Strategic Assessment and Forecast Till 2025: BNP Paribas, Deutsche Fac …

The Latest Released Global Factoring market study offers a critical assessment of key growth dynamics, emerging avenues, investment trends in key regional markets, and the competitive landscape in various regions, and strategies of top players. The assessments also offer insight into the share and size of various segments in the Global Factoring market.

Major Players in This Report Include,

BNP Paribas (France), Deutsche Factoring Bank (Germany), Eurobank (Greece), HSBC Group (United…

Factoring Strategic Assessment and Forecast Till 2025: BNP Paribas, Deutsche Fac …

The Latest Released Global Factoring market study offers a critical assessment of key growth dynamics, emerging avenues, investment trends in key regional markets, and the competitive landscape in various regions, and strategies of top players. The assessments also offer insight into the share and size of various segments in the Global Factoring market.

Major Players in This Report Include,

BNP Paribas (France), Deutsche Factoring Bank (Germany), Eurobank (Greece), HSBC Group (United…

Factoring Global Market Key Players – BNP Paribas, Deutsche Factoring Bank , E …

Factoring Market 2018

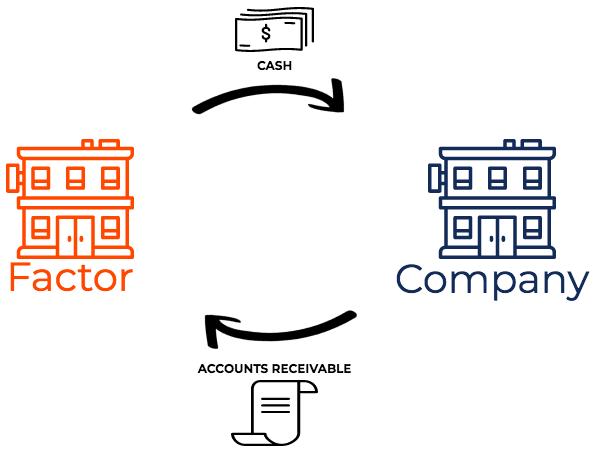

Factoring is a service of financial nature involving the conversion of credit bill into cash. It is a process or mechanism by which a company generates finance against its receivables. Factoring is asset-based financing in which the factor gives credit by looking at the creditworthiness of the borrower.

The analysts forecast the global factoring market to grow at a CAGR of 13.28% during the period 2018-2022.

Covered in this report…

7 Benefits of Factoring Your Receivables

Every year, tens of thousands of company owners across many industries discover the benefits that come with a proven cash flow solution: factoring receivables. Many businesses struggle with keeping up with expenses during those weeks or even months before customers pay their bills, yet the owners don’t want to take out loans or don’t meet borrowing requirements.

Factoring is an age-old way of turning those outstanding invoices waiting in the accounts…

Optimise factoring by mouse click

Special web portal optimises interaction between factor and clients / all documents available at all times / new release with extensive filter and export function

Anyone who uses factoring as a financing instrument or provides it as a factor knows what a flood of information is circulating about purchase and payment transactions every day. What seriously complicates the situation is that factoring institutions usually send out their information by normal…